The Kitchens Category on Amazon – Small Appliances, Big Potential

For many of us, the kitchen has transcended its traditional role as a cooking area, evolving into a versatile, multifunctional zone where dining, work, and entertainment combine.

We want our kitchens to be both functional and stylish, packed with the latest appliances, gadgets and good-looking implements – not to mention plenty of smart storage to keep it all looking neat and organised.

As a result, this is an Amazon category primed for Seller and Vendor success.

Thanks to consumers who are prioritising home cooking, health-conscious choices and stylish kitchen accessories, the Kitchen sector enjoys consistently high demand and year-round sales on the marketplace – and it contains a huge number of unique niches within its massive product scope.

Proof of the potential in this category can be found in the market projections.

Between now and 2029, sales of large and smart kitchen appliances are expected to grow with a CAGR of 7.8%, while sales of small appliances are expected to increase from £3.2 to £4.3 billion.

And, though there’s clear potential throughout the category, it’s in the small appliances sector that our data has revealed some of the most intriguing opportunities.

If you’re an Amazon Seller or Vendor looking to tap into a profitable niche within the Kitchens sector, read on to discover why small appliances should undoubtedly be on your radar.

The Shape of the Kitchen Sector on Amazon

Unsurprisingly, alongside the equally vast Homes category, the Kitchen sector is where you’ll find the most Amazon Sellers – with 35% seeking out the immense potential and opportunity on offer.

And they’re enjoying some of the biggest profits too – 30% are seeing margins of 21% and above, according to JungleScout’s State of the Seller Survey 2023.

Against competing retailers, including Tesco, Currys and Argos, Amazon enjoys its usual robust position – and this is especially true when it comes to small kitchen appliances.

Thanks in part to consumer love for the convenience of next-day Prime, globaldata.com stats show Amazon as the most-shopped retailer for these items – its massive 50%+ of the market share leaving nearest rivals Argos and Tesco in its shade.

What’s the product scope in small appliances on Amazon?

It’s pretty huge.

From kettles and coffee makers to air fryers, toasters and blenders, this is a category driven by every consumer desire you can think of; healthy eating, coffee addictions, social media trends, cost-conscious cooking – the list goes on and on.

So we asked our experts to immerse themselves in the stats and uncover the best of the riches in the niches.

Join us as we dive a little deeper…

Key Market Trends

- While this is a sector where the big name brands dominate, our data shows that there’s still room for challenger and smaller brands to establish a foothold and generate excellent revenues in a sector where profit margins are naturally strong.

- Top brands rely heavily on the automatic advantage of their strong brand name, and are rewarded with top ranks, as shown in our subcategory breakdowns below.

- However, as always, it’s still key for them to stay vigilant and protect their market share against competing brands and new challengers.

- Clean listings are a must across this entire category. Consumers want to easily see what they’re buying, and understand key information like features and dimensions quickly and without overwhelm.

- Brands of all sizes win big when they make the most of seasonal sales trends and promotions opportunities like Prime Day and Black Friday, which see super-strong returns for small electrical goods (like Air Fryers – see below).

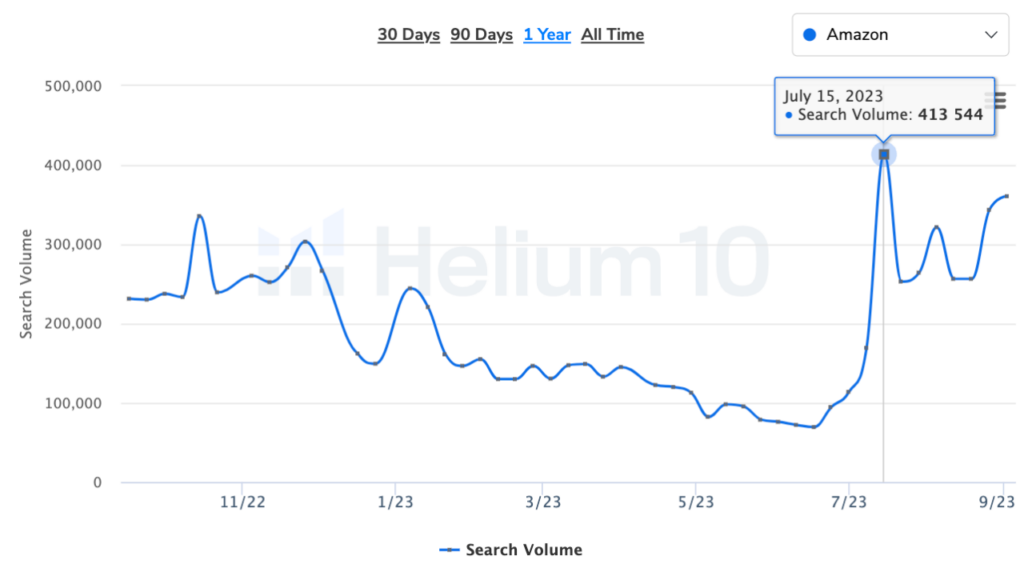

- Ninja, for example, make smart use of Prime Day, and are rewarded accordingly – in July 2023, their searches rose by 4x to more than 800,000 thanks to their clever promotional strategy for the event.

Know you need expert help to drive your Kitchen sector sales? Click here

Spotlight on Subcategories

We’ve chosen four subcategories with promise to highlight:

- Coffee Machines

- Kettles

- Toasters

- Air Fryers

Why these four?

As always, we’ve chosen the subsectors which combine the highest searches and revenues, pinpointing the ones with the most potent blend of strong profits, versatility and rapid growth potential.

Although dominated at the top ends by big-name brands, these subcategories also attract plenty of consumers looking for form and function at a lower price, as well as the latest innovations.

But first… A-Game Optimisation is non-negotiable

There’s one thing we must flag when it comes to the small appliances categories.

We always, always talk about the importance of excellent optimisation to stand out from the crowd.

Well, in these subcategories, it’s not a differentiation – it’s a must.

This is a super-competitive sector as a whole and even the biggest brands, who can sometimes rest heavily on their laurels when it comes to quality of listings, are ON IT here, with A+ content, high-quality images, video and 3D modelling galore.

If you’re moving into any of these subcategories, you must have your optimisation A-Game on no matter what, and combine smart product choices with clever PPC strategies and strong review collation to gain your competitive edge.

Need help? Speak to our expert team today.

OK – lecture over, let’s dive in!

Coffee Machines

Consumer desire for home coffee machines has surged in recent years, and it’s not only in the aftermath of Covid.

Improving technology means good coffee machines can rival shop-bought coffees on consistency and quality, they’re more user-friendly than ever before, they’re more eco-friendly than single-use cup coffees and, most importantly for buyers, a home machine is simply cheaper than daily trips to the coffee shop.

With room for innovative and premium products alike, this is a subcategory with promise to spare…

During our 30-day analysis (Sept 2023):

- There were an average of 36,758 searches for “coffee machine”, and just under 360k units sold.

- Split between 46 brands, the top 100 listings in this subsector earned a combined total of £4.6 million.

- Total category revenues were a massive £9.3 million, so a further £4.7 million was shared between listings outside the top 100 – demonstrating the sheer potential on offer for brands of all shapes and sizes!

- Between them, De’Longhi, Sage, Nespresso and Dolce Gusto account for 28.65% of the category revenues, with De’Longhi earning the most by far, their £1.02 million accounting for 22% market share alone.

- There’s hope for smaller brands – on average, the top 100 listings earned revenues of £47k each, with those placed between 51-100 hitting average sales figures of £24k in September 2023.

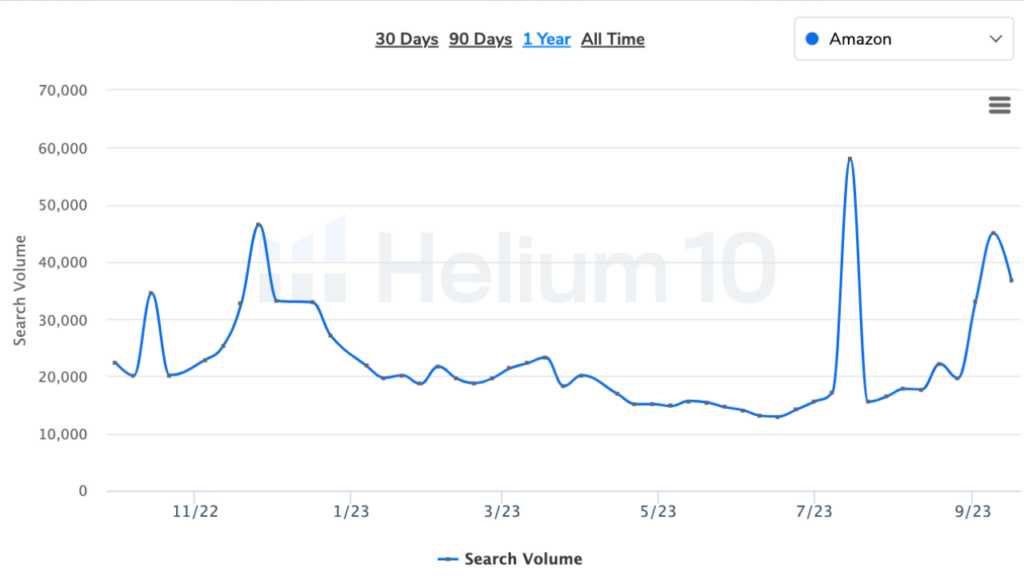

- Peak searches within the last 12 months were July’s Prime Day, and then a steady series of spikes in the run up to Christmas that covers October Amazon events, Black Friday/Cyber Monday and a big lift in mid-December.

Key market trends and opportunities in Coffee Machines

- With brands like DeLonghi and Nespresso so dominant, A-game optimisation is non-negotiable for competitor and smaller brands alike. Unlike other sub-categories, here the big brands are going all out with their listings, not just relying on their name and reputation to make sales. They’re using every element that Amazon offers to their advantage, from Premium A+ content to quality infographics – so your brand must do that too.

- At the lower end, you’re competing against brands whose listings have good reviews but no A+ or brand store, so there is absolutely an opportunity to gain an edge with your own well-optimised listings.

- Good reviews are crucial. Average ratings here are 4.2 stars, so new entrants and new listings need to supercharge their review collection strategy through Vine or similar to compete.

- Any brand within this category needs a strong PPC strategy that’s tailored to their existing position within the market. For example, bigger and challenger brands should be looking to target key competition and increase their market share, while smaller brands should be looking at creating as much buzz and awareness as possible.

- Smaller brands – focus on building relationships and trust with your potential customers, beginning with your initial listings, then your brand store, and then effective PPC campaigns.

- Events are key. There’s a huge spike for Prime Day in July, and another around Black Friday. Even though these are daily-use products, they’re still luxury purchases, so buyers are looking for promotions and discount opportunities.

Kettles

This kitchen stalwart covers a surprising range of options – from entry-level to state-of-the-art tech; traditional to modern art looks; stainless steel to glass, and everything in between.

With 117,000 searches just over our 30-day analysis, our data reveals a sub-sector with year-round popularity and endless innovations and options for Sellers and Vendors to home in on – there’s room for new players in Kettles…

During our 30-day analysis (Sept 2023):

- There were 116,956 searches for “kettle”, and just under 122k units sold.

- Split between 45 brands, the top 100 listings in this subsector earned a combined total of £3.1 million.

- Total category revenues were £4.2 million, so another £1.1 million-worth of sales outside the top 100 listings.

- Russell Hobbs, Breville, Bosch and Swan take 40% of the category revenues between them – but among the rest of the listings there are plenty of lesser-known names, showing that there’s potential for bargains and innovators alike.

- Prime Days and promotional events are crucial sales periods for all the small kitchen appliance products that we’ve looked at, and kettles are no different. Aside from replacement through need, these purchases are often driven by deals.

Key market trends and opportunities in Kettles

- While there’s plenty of presence from big-name brands in the top 50 of this subsector, what’s interesting is that their dominance is interspersed with lesser-known names, like top 10 brands COSORI and Enocos.

- This suggests that, like Air Fryers (read on…), here’s another subsector where some consumers are just after a stylish bargain, not necessarily a name-brand product – a good sign for challenger and smaller brands.

- Attractive images and plenty of information are key for a successful Kettle listing, with some of the most successful overlaying key benefits (like “BPA Free”) over their lead images to catch the eye in the results.

- As well as high-quality images and premium A+ content, video is a great sales tool here – as are 3D models of the product and use of the “see this in your home” feature.

- For the well-optimised, there’s plenty of share for grabs in this sub-sector. At the lower end of our top 100, brands like Cuisinart are mixing a small number of reviews with really basic imagery and A+ – yet still hitting a top 100 spot.

- And if the riches are in the niches, here is a prime subsector for those. Kettle forms and functions vary wildly these days, and there’s plenty of scope to innovate or create something good-looking and new.

- Let’s take a quick look at number 6-ranked brand Enocos. With no brand store, their listing was new as of May 2023, has only 67 reviews at 4.4 stars and has the most basic of titles – so how on earth is it currently Amazon choice for kettles, ranked 3rd in “Electric Kettles” and generating £218k over our 30-day analysis?

- Our experts think the key is their clean, consumer-friendly listing. A brilliant example of smart optimisation, their clear infographics and A+ content with detailed-yet-simple bullet points show how strong content can lift a product above its competition.

- A cautionary note from our team though – following this type of rapid success, the next step must be to ensure that sales are turned into reviews for a stronger brand. Long-term success against sector leaders like Russell Hobbs, whose top listings have around 8,000 reviews, will be dependent on this.

- Two key features on the rise are smart kettles (with Wi-Fi connectivity and/or voice control) and energy-efficient models with auto-shutoff features that appeal to eco-conscious buyers.

- Another idea is to seek out the niches – and then play the Amazon game perfectly. 5th-placed brand COSORI has ranked highly for their Electric Glass Kettle with a main image that’s highly visual and includes a “BPA free” infographic. These combine both to catch the eye and immediately entice a buyer with a sustainable message.

- After clicking on the product? COSORI are driving strong sales with a promotion offering a 10% voucher. Promotions are a brilliant way to secure a sale in a competitive subsector once your lead image has encouraged the click. A clever one-two from COSORI here.

- And, following up on the note above, COSORI have clearly focused on brand trust building as a crucial element of their sales strategy, with an immense 36,000+ reviews (at 4.3) that are helping them hold the Amazon Choice position for the search term “Glass Kettle”.

Toasters

Trends in toaster purchases on Amazon are based on a blend of speed, versatility, style and technology, reflecting the diverse needs and preferences of today’s consumers.

With such scope and year-round demand (that echoes the strong peaks around promotional events we see elsewhere in this category), this is a subsector with plenty of promise for Sellers and Vendors.

During our 30-day analysis (Sept 2023):

- There were 43,159 searches for “toaster”, and just under 42k units sold.

- Split between 26 brands, the top 100 listings in this subsector earned a combined total of £1.3 million.

- Total category revenues were £1.65 million, so here, the majority of sales are taken by the top 100 listings.

- Russell Hobbs, Breville, Dualit and Morphy Richards take almost 50% of the category revenues between them, but average revenues overall for the 30 days are a healthy £13k.

- Again there’s a key peak around Prime Days and promotional events, but demand is strong through much of the year – even with clear signs that buyers hold off before events (see that drop through June!)

Key market trends and opportunities in Toasters

- Key players dominate, with Russell Hobbs taking nearly 23% of the category revenues through our analysis, but there are still opportunities for challenger and smaller brands alike.

- Again, demand for innovative, smart capabilities is on the rise, as well as features that deal with artisanal and shaped breads, waffles, paninis and more.

- Turning to specifics, although reviews here are (as ever) key, some brands at the lower end of the top 100 have gained traction even with a small number of reviews through their high-quality listings content.

- Where they could improve further is by implementing much stronger PPC campaigns – weak Amazon Ads efforts aren’t giving them the visibility they need to perform well and attract buyers.

Air Fryers

Yes, here they are!

Second only to coffee machines when it comes to generating revenues and with an average search volume of 360,700 in Sept 2023, there’s no doubt that Air Fryers are here to stay, their popularity sitting pretty on a wave of healthy eating and consumer cost-consciousness.

- The market is dominated by Ninja, whose 44% of total revenues generated over our 30-day analysis (Sept 2023) effortlessly eclipses top rivals Tower (£1.63 million = 18%) and Tefal (£713k = 7%).

- Yet there are still 57 different brands within those top 100 listings with a combined total revenue of £10.5 million – even those in the spots between 90-100 are averaging £10k sales months.

Key market trends and opportunities in Air Fryers

- Tempted to discount this subcategory because of the strength of Ninja and Tower? Don’t be. The sheer number of brands within the top 100 shows that there’s plenty of room for competition – and let’s mention again here that 30 day search volume of 360,700.

- Not every consumer can afford a Ninja or Tower Air Fryer – plus many buyers come to Amazon looking for a bargain, so smart pricing is one way that challengers and smaller brands can gain an edge.

- Is there anything that Ninja are missing on their listings? Very little, as their content is excellent; clean, clear and compelling. But our experts can always find room for improvement! There are no infographic images for example, and lesser-known brands would want to include content that explains why their brand and their product is the best option.

- You can have too much of a good thing – as demonstrated by the heavy infographics and A+ banners used by the brand LLIVEKIT (30-day sales of £52k). Overusing graphics can feel too much – aim instead for a clean, attractive look that ticks all the informational boxes.

Suggested Selling Models in the Kitchens Category

A quick assessment of the top 500 listings on Amazon within the Kitchen category reveals that fulfilment is split fairly equally between FBM (261) and FBA (200).

With the number of big brands selling in this sector who have multi-channel fulfilment capabilities, a swing in favour of FBM is not surprising.

However, even for the bigger boys, Amazon fee increases over recent years are making it harder and harder for FBM brands to maintain margins at their usual price points, so it’s key for new entrants and existing brands alike to undertake regular unit economics modelling exercises to protect their profits.

Read more on maximising your profitability on Amazon here

Our Tips for Success in the Kitchen Sector on Amazon

There’s no doubt that the Kitchen category offers huge potential for brands old and new, big and small, especially when it comes to selling small kitchen appliances.

For bigger brand names, it’s all about taking further control and market share from the competition sitting alongside them in the top 100 listings.

How?

Strong positions can be strengthened still further by implementing a continual optimisation process that keeps every element of your Amazon presence at the top of its game – from listings to Storefronts to Amazon Ads.

And it’s always important for brands at every stage of their development to squeeze every penny of margin out of product sales.

Using real-time reporting and making the right choice in the “internal vs external Amazon resource” debate are important aspects of maintaining strong profitability – both topics we’ve covered in more depth on our blog (see the “Useful Links” section below).

For smaller and challenger brands, there are so many exciting opportunities to discover in this sector.

There are niches where there is massive demand and the top listings are shared between many different brands, from the biggest names to complete unknowns.

And listings are performing well with no brand store, low review counts and other glaring improvements that could be made – marking out huge opportunities for those prepared to play an Amazon A-Game.

Time to play your own Amazon A-Game? Speak to our team of experts

Our 8 top tips for success in the Kitchen sector:

- Fully optimise your Listings

Use high-quality images and infographics, ensure your titles and bullet points are keyword-rich, incorporate video where you can and use A+ content.

- Keep it clear

Don’t overcomplicate when it comes to text and imagery.

Make your images visually arresting without being fussy so you stand out in the results, cover the most important details (dimensions, features) visually and in your copy and keep bullet points simple, informative and complete.

- Make use of compelling content

Got user-generated content that you’re using on other platforms, like social media?

Incorporate it here too – buyers are looking for a full picture. If it’s working for you elsewhere, it can work for you on Amazon too.

- You’re not just selling a product, you’re selling a brand

Smaller and challenger brands – don’t lose sight of the need to build a strong relationship with your buyers via relatable content and great reviews.

Smaller brands should also make use of Amazon badges to help shape their brand narrative. From the Small Business badge to Climate Pledge Friendly, these are small but effective ways to help your products stand out and project your brand ethos.

- Look to the wider consumer world for trending product ideas

For those brands agile enough to move quickly, social media channels – TikTok and Instagram Reels especially – are an absolute gift for brands looking for the next consumer craze across the Kitchen sector.

- Never stop chasing reviews

As with any competitive category on Amazon, your listings can live and die purely on the strength of your reviews, so have a strong collection strategy in place (our experts use Vine – speak to us to learn more).

And never slow down on asking for feedback, even when your product sales have picked up momentum.

- Buyers in this sector are looking for good prices…

So make sure you’re making best use of key events, seasons and Amazon promotions.

- Drive sales with Amazon Ads

The smart use of Amazon Ads features is such a brilliant way to gain market share that it always amazes us how existing Sellers and Vendors aren’t using them to their full potential.

Looking for help? Look no further. Our PPC experts were recently shortlisted for the prestigious EMEA Challenger Award at the Amazon Ads Partner Awards 2023 for their innovative campaign work. Click here to see what they can do for your brand.

- Be smart with Events and Promotions

For listings with conversions punch, combine your most compelling imagery with clever promotions to seal a sale after you’ve gained the click.

And don’t miss out on the brilliant opportunities that Amazon Events offer to boost your sales – from summer Prime Days to Black Friday and Cyber Monday.

- And finally… Fulfilment

When it comes to fulfilment, it’s generally a good idea in this category to let Amazon take care of it.

Buyers are buying online – and on Amazon particularly – because they want the convenience of easy, reliable and cheap next-day Prime deliveries.

Plus, Amazon’s increasing fees and charges are putting other fulfilment models in FBA’s shade – not to mention the fact that Amazon’s new “Supply Chain by Amazon” looks set to be an absolute game changer for brands moving goods between manufacturers and consumers.

Amazon is moving to make themselves the most sensible option so, unless you have an excellent alternative in place, or are subject to size restrictions that make FBA tricky, you may as well move with them.

From Amazon strategy to SEO, PPC to content and beyond, our full-service marketplace offering has everything you need to succeed – and our team of time-served Amazon experts is here to help grow your brand to its full potential.

Say hello – we don’t bite – and discover how we can take the mystery out of Amazon marketplace and replace it with something altogether more magical – results, growth, performance and profit.