For the second of Venture Forge’s deep dives into Amazon categories, we delve into the depths of Activewear to see who are the winners, fighters and success stories in another one of Amazon’s best selling categories in the UK.

If you have a brand and would like us to look at doing a deep dive on your category in the coming months, please feel free to get in touch.

Activewear on Amazon – What’s it worth?

Across both mens and womens on Amazon, activewear accounts for an incredible 352,000 units of stock sold per month up to a total value of £6.3m of sales. This is from our analysis of the top 40 to 60 items in each subcategory of activewear and is likely to underplay the true size of the opportunity.

Over a full year in the UK, this creates up to a £75.6m annual category for brands selling activewear on, or to, Amazon.

Whilst in most general retailers womens sales often account for 60%-70% of the split in this category, on Amazon the balance shifts with the sales split being 55% female, 45% male, but this does vary significantly when you go into the sub-categories of shorts, bottoms, tops and compression wear.

In leggings/bottoms, for example, women take a 62% share of the market, whereas in shorts they only take 43%.

The best sellers in activewear on Amazon

With household names like Nike, Adidas, Puma, Reebok and Under Armour all present on Amazon it would be fair to expect them to be dominating Amazon’s sales of activewear.

Perhaps one of the biggest stand outs in this category is the success of ‘non brands’ and the huge sales volume going through generic products where the manufacturer has excelled at selling on Amazon, rather than in building a brand the traditional way.

The Top 5 items in activewear on Amazon are:

- MEETYOO Mens Base Layer – £190k/month

- MEETYOO Mens Compression Shirt – £160k/month

- Under Armour Mens Heatgear Base Layer (Blue) – £138k./month

- Under Armour Mens Heatgear Base Layer (Black) – £122k/month

- RXRXCOCO Women’s Scrunch Leggings – £78k/month

This trend continues throughout the top five of almost all subcategories, with unknown brands that have mastered both product sourcing and Amazon selling dominating the big brands.

Big activewear brands suffer from a historical lack of Amazon strategy

As has become evident from just looking at the top few items in each category – unknown brands do disproportionately well on Amazon.

Looking deeper into this another key metric stands out in activewear and that is the small difference in price between branded and unbranded goods.

We initially suspected that the unbranded goods sellers were using their market dominance to drive their prices higher, but on further checking, we spotted that the opposite was true – a lack of control over their Amazon strategy by the bigger brands has caused their brand and price point to be eroded to a point where they’re barely more expensive than unbranded goods.

Take two of the five best sellers above:

The MEETYOO Men’s Compression Shirt is sold at £14.98, has a stable price and no buy box competition. It’s effectively a private label brand, owning its own listing and with no resellers it has no price pressure.

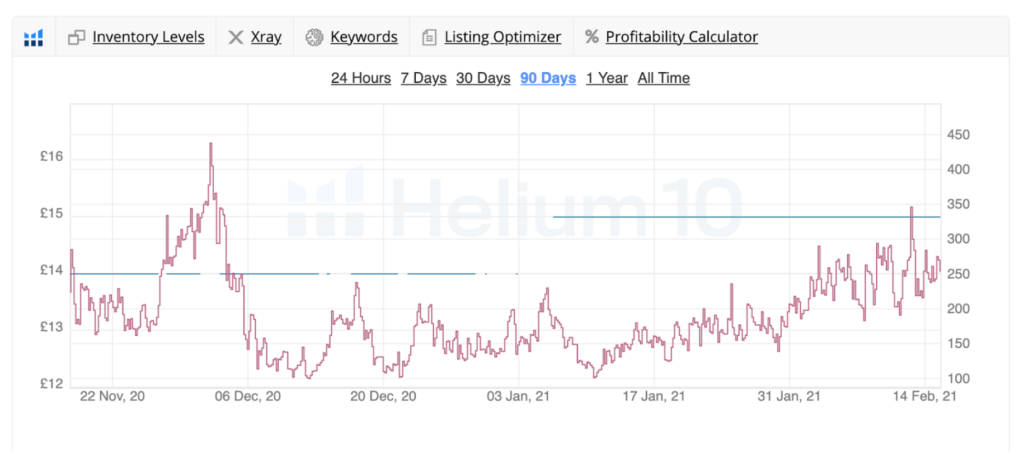

Its price has actually gone up in the last 90 days as shown on the blue line below.

As a comparison, the Under Armour Compression Shirt is sold at £20.97, a £10 discount off its RRP. It has been under constant price pressure from between 5 to 10 different sellers in the last 90 days and every drop in their selling price correlates to when a new seller came on to their listing, forcing a price drop to win the buy box.

For the larger brands, their historical “sell to anyone” sales strategy has resulted in them losing control over their brand and price point on Amazon, and ultimately their loss of market share to unbranded manufacturers who have full control of their products in that channel, at a deeper margin.

It is important to highlight that price-fixing and manipulation are strictly forbidden in the UK.

What we’re highlighting here is that it’s very clear that a lack of channel strategy has caused some of the big brands to be significantly undervalued as brands (by using price as a proxy) when compared to others in the market.

How activewear is sold on Amazon

Looking at Amazon’s various selling models (Amazon Vendor, Amazon Seller Fulfilled by Merchant and Amazon Seller Fulfilled By Amazon) there are some interesting splits across the category.

Amazon FBA dominates with 68% share of the items we have analysed – which means that most brands are selling through Amazon Seller and utilising Amazon to do their shipping.

Whilst this may not seem surprising, due to the ease of shipping these goods and therefore the relatively low cost, it is at odds with the wider fashion and apparel markets where, for example, womenswear only sees 39% of its revenue through FBA.

The remaining sales split out as 20% Amazon Vendor and 12% Amazon Seller on the FBM model.

The general trend across the category seems to be:

-

- Larger brands (Under Armour and Adidas in particular) working with Amazon on a Vendor basis, which is typical of big brands who want more of a ‘trade’ style relationship and bigger volume orders, but often correlates to lower quality of listing and therefore an opportunity to compete against them,

- Some large retailers/brands working on a blend of FBA/FBM, which is often done to manage stock placement and stock risk across multiple sales channels, but does leave them uncompetitive on the FBM model due to the lack of Amazon Prime.

- “Non brand” sellers, who seem to be exceptional at selling on Amazon and heavily depend on Amazon Prime (and therefore use FBA) to give them an advantage.

- Opportunists, who may run a small shop or retail outlet and have access to the product from the big brands, and simply list against existing listings to grab a sale whenever they win the buy box, often at the detriment of the brand by crashing the price and eroding brand value.

The costs of selling activewear on Amazon

Activewear comes under fashion on Amazon and as such is one of the few categories on Amazon with a tiered pricing structure.

Fashion operates on the following fee structure:

-

- For Fulfilment by Amazon (FBA) and Seller Fulfilled Prime selections:

- 15.3% for the portion of the total sales price up to £40.00

- 7.14% for any portion of the total sales price greater than £40.00

- For all other selections:

- 15.3% flat fee

- For Fulfilment by Amazon (FBA) and Seller Fulfilled Prime selections:

Where Amazon offers a tiered fee structure, this typically shows their commitment to grow a category by incentivising sellers to bring new products to their platform to help drive that growth, or to reflect a margin challenge that the seller may be faced with.

Ways to win at activewear on Amazon

Having looked in depth at this category and analysed a large number of listings, here are our tips to succeed in activewear on Amazon.

Protect your brand

Whilst Amazon offers tools to brands (Brand Registry) to help them protect their brand on Amazon, we’re talking here about much more fundamental controls over your brand and protecting its image in key sales channels.

As a brand you cannot fix your price or employ mechanisms to do so, but you can in limited circumstances protect your brand through selective distribution systems. Richard Bailey at Steeles Law has a very good article on the details around this.

Some of the largest brands on Amazon are being significantly undervalued and eroded based on their lack of amazon strategy and considerations around their multi-channel approach.

Invest in your listing and imagery

Whilst we could write this on every piece of category insight we produce, we’ve been surprised by the relatively low bar in activewear on Amazon.

Great product and lifestyle imagery are rare in activewear on Amazon, and when you compare the photography across all of fashion on Amazon, with that on some of the best online fashion retailers sites it is clear this is underplayed on Amazon.

A clear cut out shot is required for your primary image on Amazon, but beyond that lifestyle goes a long way. Fashion and apparel is all about how it fits, how it feels and how it looks and you don’t see that being done well on Amazon today in this category.

Use and manage your variations

The most successful listings in activewear are well structured, well managed and well-curated.

For most this means using “Parent > Child” listings with a clear use of variations for colours, styles and size, which for the consumer creates a clear and easy buying journey.

For the seller, this also results in your reviews and ratings being grouped, so from a parent listing perspective you end up in a very positive position.

Go all out for reviews

With a lot of activewear being made up of core lines, rather than seasonal variations, many listings have been around for a long time and that (for the good products) means a significant number of reviews.

Trying to compete with such lines is tough and will take time (sometimes a couple of years) to do.

Building this into your strategy from Day 1 will be fundamental to succeeding in activewear and we’d recommend the following:

-

- Make use of the Amazon Vine reviews scheme to its fullest. Give away the highest number of items possible to generate the highest initial number of reviews for your products.

- Use the Amazon Early Reviews Program to its fullest. You see the theme here?

- Invest in your price and your advertising to drive sales volume. There are no shortcuts to collecting reviews so maxing your sales volume is the quickest way beyond the above two tips. Run deals, trade your price, use PPC to your advantage (more on that in a second) and do all you can to drive your sales velocity, sacrificing short term margin for longer-term success.

Invest heavily in PPC

From our experience in activewear, we’ve seen paid advertising costs of sales (ACOS) as low as 10%, and this is often one of the cheaper categories to advertise in when you get your listings into a good position. Investing here can drive greater profit levels than in other categories.

Knowing how important reviews are to this category, we’d recommend viewing this slightly differently. With lower than average costs of sales on advertising, we’d encourage brands to take a longer-term view and invest their margins into outbidding competitors, driving sales volume and reviews in order to drive your sales velocity and longer-term success.

Spending heavily and investing your margin in ads on activewear can give you a real edge over the competition in the long term.

Want to find out more?

The data and insight shared in this report is a brief summary of the data we have available on women’s fashion on Amazon UK. If you’d like to explore this in more detail with us, we’d love to hear from you.

At Venture Forge, we provide a full Amazon management service for ambitious brands looking to grow their sales through Amazon across the UK, Europe and globally.

If you’re considering selling on Amazon or looking to boost your existing sales, we’d love to have a chat and see if we can help.